Mutualism provides four main business financing solutions: Asset-Backed Finance for equipment and machinery, Contract Financing for government and corporate contracts, Invoice Discounting to unlock cash from outstanding invoices, and Working Capital loans for day-to-day business operations.

Our repayment periods are designed to suit your business cash flow, ranging from a few months up to 18-24 months. We understand that businesses sometimes face unexpected challenges, which is why we offer flexibility including leniency for one missed payment to help keep your business on track.

We finance businesses across all industries in South Africa. Whether you're in healthcare, telecommunications, manufacturing, construction, retail, events and catering, professional services, or any other sector, we tailor our financing solutions to meet your specific industry needs and challenges.

Mutualism offers business financing from R20,000 to R5 million, making our solutions accessible to both small businesses and established enterprises looking to grow their operations or manage cash flow.

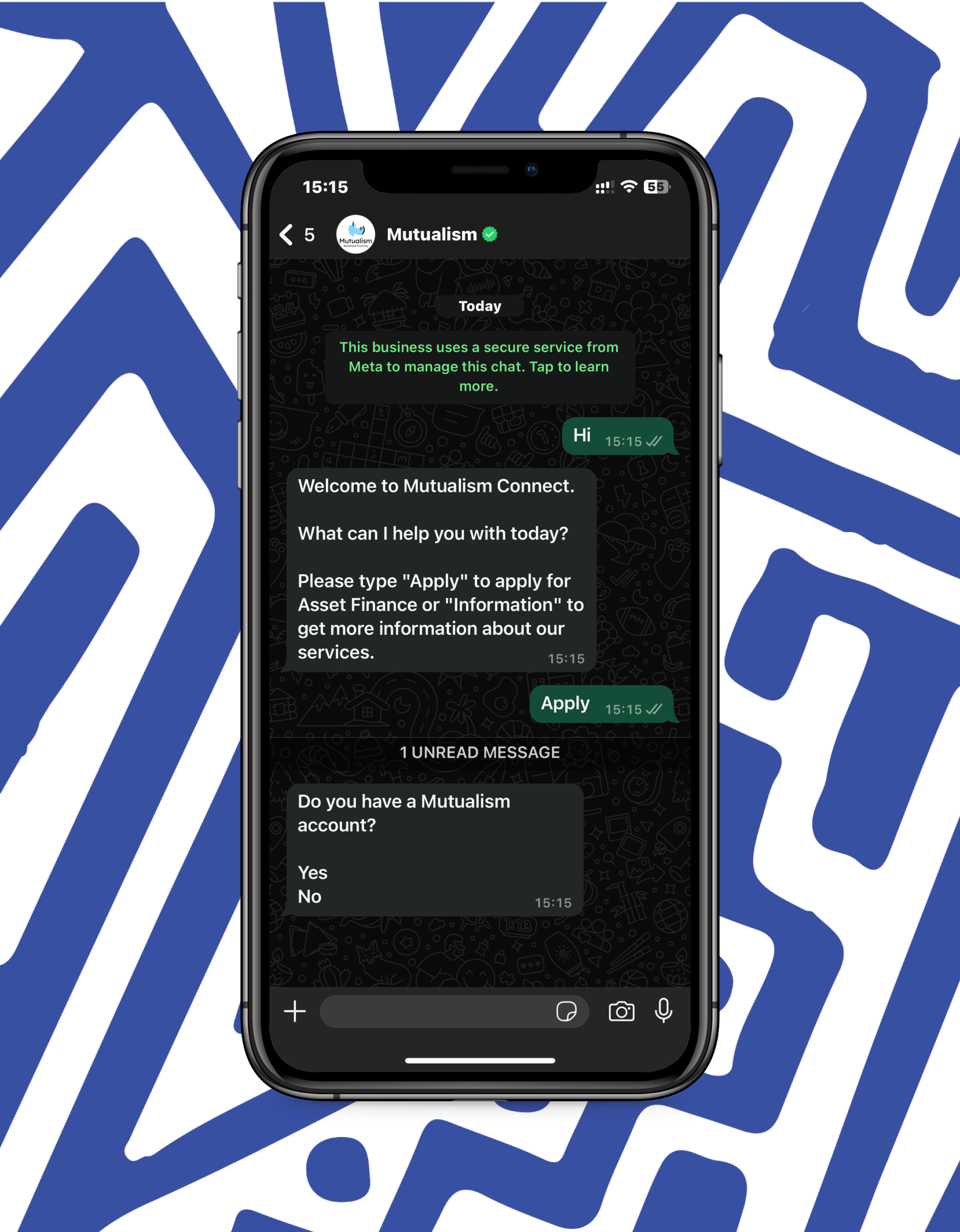

Applying for business financing is quick and convenient. You can apply through our AI-powered WhatsApp chatbot for instant assistance, complete our simple online application form on our website, or use our secure business portal. Choose the method that works best for you.

The required documents vary depending on the type of financing you need, but all applications start with your 6-month business bank statements. Once we receive these, our experienced financial analysts use advanced algorithms to assess your business and recommend the most suitable financing option for your needs.

Mutualism provides fast financing decisions. Our team typically provides feedback on your business financing application within 48-72 hours, allowing you to access the funds you need quickly to keep your business moving forward.

Yes, through our Asset-Backed Finance solution, we can help you acquire the equipment, machinery, or vehicles your business needs. We purchase the equipment for your business and use it as security for the loan, making it an affordable way to access essential business assets.

Absolutely. Our Contract Financing solution is specifically designed to help South African businesses fulfill government tenders and corporate contracts by providing upfront funding while you wait for contract payments.

Invoice discounting allows you to unlock up to 80-90% of the value of your outstanding invoices immediately, improving your business cash flow while you wait for customers to pay. You maintain control of your customer relationships and collections process.

Working capital financing provides short-term funding to cover your day-to-day business expenses such as payroll, rent, inventory purchases, or seasonal cash flow gaps. This ensures your business operations continue smoothly even when facing temporary cash flow challenges.

Our consultants are available to assist you further. Please do not hesitate to contact us.

Get instant answers to your questions